New rules on GST invoicing apply from 1 April 2023. These changes have been designed…

The new unexpected burden on landlords

On 23 March 2021, the government proposed some major tax changes which they believe will fix the housing market and slow down house price increases.

These changes will have a major impact on landlords. There are a lot of details that are still unclear so we do not have definitive answers for you yet. However, although the details are still being worked out, here are some of the major changes proposed:

- You will no longer be able to deduct interest you pay from residential rental income. This deduction will be phased out over time.

- The bright-line test will be extended from 5 to 10 years, except for new builds.

- The main home exclusion will not apply to properties that weren’t used as the main home for the entire time, with some exceptions.

Below is more information about these changes and how they would affect landlords.

1. Phasing out the interest deduction

Currently, if you pay interest on a loan that relates to a residential investment property, you can deduct the interest from your income to reduce your taxable income.

This will change from 1 October 2021.

- For residential properties bought on or after 27 March 2021, no interest will be deductible from 1 October 2021. You will still be able to claim interest in the months leading up to October.

- If you bought the property before 27 March 2021, interest will still be deducted. However, the amount you’ll be able to claim will decrease over the next 4 income years, until it’s completely phased out by the 2025-26 year.

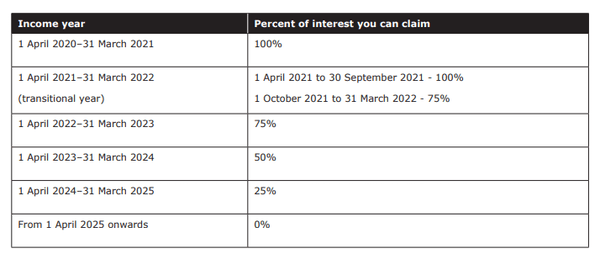

Below is a table showing how much interest you’ll be able to claim each year:

There are certain exceptions to the rule:

- If you have a business loan that is secured against the residential property, you will still be able to deduct the interest as a business expense.

- Property developers will continue to be able to deduct interest from their income.

2. Changes to the bright-line test

If you sell a residential property within a set period after you bought it, you will need to pay income tax on the profit you’ve made. This is called the bright-line test. The current period is 5 years for properties bought after 29 March 2018. The period has now been extended to 10 years for any residential buildings purchased after 27 March 2021.

For instance, if you made a profit of $100,000 on the sale of a property, you bought it after 27 March 2021, and you sold it within 10 years, you will pay income tax on the $100,000.

There are a few exceptions:

- The period for new builds will continue to be 5 years.

- If you inherited the property, it would still be exempt from the bright-line test.

- If you used the property as your main home the entire time, it would be exempt from the bright-line test.

If you didn’t use the property as your main home the entire time (apart from a 12-month grace period), then you will need to do an apportionment calculation. For instance, if you made a profit of $100,000 on the sale of the property, used it only 50% of the time as your main home, and you purchased it after 27 March 2021, you will need to pay tax on $50,000 (100,000 x 50%).

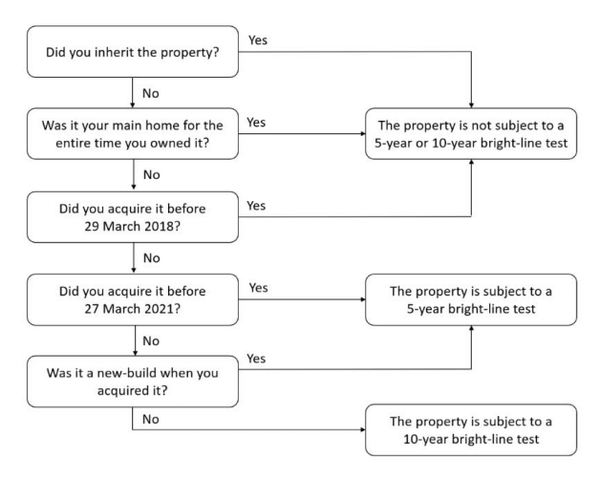

Below is a nifty flow chart that explains when and how the bright-line test will be applied:

Impact on landlords

As you can see, as a landlord your tax bill may increase significantly, depending on how much interest you pay on your mortgage. If you aren’t able to deduct interest from your rental income, which is often the largest portion of the deduction you’re able to make, your profit will be higher. This means the tax you pay on the profit will be higher as well.

For instance, let’s say the interest you pay on your home loan is $20,000 every year.

- In the 2023 year, you’d only be able to deduct 75% of that, so your profit would be more with $5,000 (20,000 x 25%). If you’re on the highest tax bracket of 39%, the additional tax you’ll pay is $1,950.

- In the 2026 year, you won’t be able to deduct any interest. Your profit would be $20,000 higher, and the tax on that, if you’re on the 39% tax rate, would be $7,800.

Before you make any decisions to sell your property or increase rental, perhaps wait until we have more information. We’ll keep an eye on developments and keep you up to date as we learn more. Once we have a clearer picture of the new rules and regulations, come have a chat with us. Let us have a look at your business and investment structures and see if there are any changes you could make to these to lower your tax burden.

Comments (0)